Pink sheet stocks often raise a red flag for many investors. If you are looking to start investing, you may be curious about these off-road trading options. Some investors turn to them as a means of high returns, as a pink sheet stock can sometimes return multiples of its basis. The process for trading these stocks is different than in the mainstream stock market. Before you make a decision about whether or not you will invest, it is important to understand exactly what pink sheet stocks are and how they operate. Below, you will find a comprehensive guide of everything you need to know about pink sheet stocks.

What Are Pink Sheet Stocks?

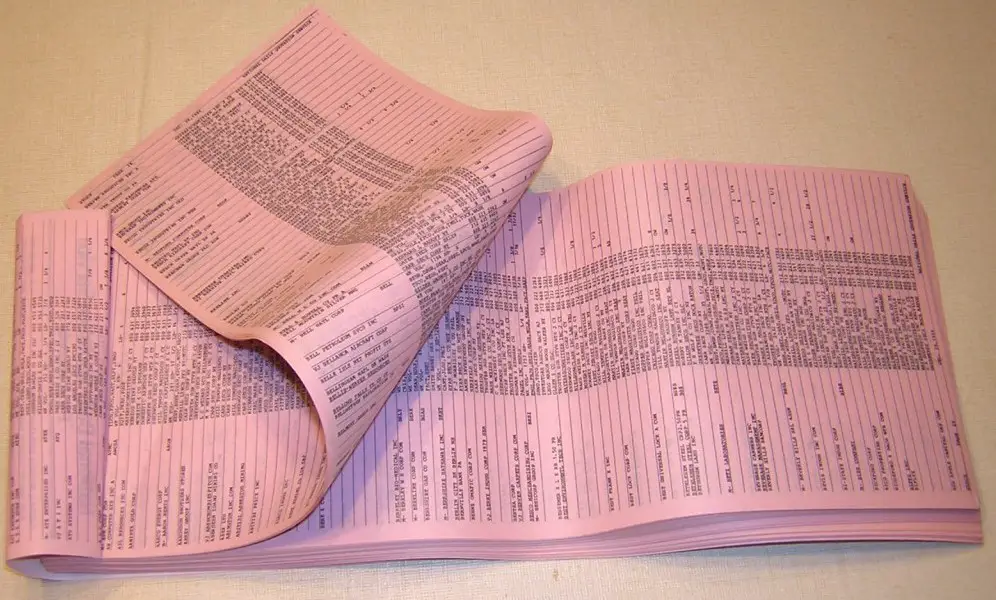

The term pink sheet stocks refers to over-the-counter trading of stocks for companies that are unable, unwilling or otherwise ineligible to be listed on a major national exchange. This is not the same as stock market trading. The Securities and Exchange Commission (SEC) does not regulate these stocks. Instead, pink sheet stocks are daily publications of bid-ask stock quotations. In addition to the lack of regulation and standards, pink sheet stocks do not have a trading floor, and listed companies are unable to trade on other stock exchanges.

Why Are They Called Pink?

Pink sheet stocks are named as such because they were historically printed on pink paper. Unlike Intuit stock, which is listed using the modern electronic system, these pink sheets were used to carry out secondary market sales. Pink Sheets LLC adopted the phrase for their own use until a few years ago when they were re-branded as OTCMarkets. OTCMarkets is the trading hub for pink sheet stocks. They are not registered with the SEC.

Who Participates In Pink Sheets?

Pink sheet stocks are created by market makers who handle individual stocks. Approximately 15,000 stocks trade on the Pink Sheets, all of which range from large foreign companies to tiny start-ups. Pink sheet stocks are often small, thinly-traded issues that often carry a great deal of risk. The investors who trade in pink sheets are often drawn to them because of their low cost per share – some selling for as little as a few pennies – and the potential to find strong companies among the many start-ups.

What Are The Listing Requirements?

The listing requirements for pink sheet stocks are virtually non-existent. This is a similar concept you will learn when figuring out how to buy a foreclosure. Essentially, all a pink sheet stock company needs to do to get listed is submit Form 211 with the OTC Compliance Unit. This form includes basic information such as issuer and security information, recent issue trading suspensions, and the identity of the person for whom the quote is being submitted. This information, along with a firm employee’s signature will allow a pink sheet stock to be listed.

Be Cautious

If you have not seen Wolf of Wall Street, you may need a reminder. You should always be cautious when dealing with pink sheet stocks. This is true even if you have the help of a Yacktman professional. Pink sheet stocks lack liquidity. This makes them volatile for even the most seasoned investor. Make sure to practice patience and caution when buying or selling pink sheet stocks. This is one of the most important things to remember regarding this type of investment.

Pink sheet stocks are complex stock options, even for the most seasoned stock investor. Some investors are drawn to the high-risk, high-reward phenomena that comes with these stocks. Others enjoy the benefits of low-cost shares. Regardless of how or why investors take part, this is an important and often overlooked sector of the finance industry. Pink sheet stocks are a tricky industry to deal in. However, if you are an investor you too may be drawn to the potential rewards. The next time you are looking to invest in something, consider this post to determine whether or not pink sheet stocks are right for you.

Photo from http://www.fluentu.com/english/business/blog/business-english-finance/

Business First Family Business, Accounting, Finance, Investing, Marketing And Management

Business First Family Business, Accounting, Finance, Investing, Marketing And Management