Do you know the difference between taking out a student loan and refinancing one? When you take out a loan you get fresh funds to pay for school costs, and the lender charges you interest on the loan. Sometimes these interest rates can be higher than the current market rate. Therefore, you might want to take all the steps that you can to reduce interest on your loans. Refinancing refers to a loan you already have, and you exchange the loan for a new one with lower interest.

Amazingly, many people don’t take advantage of refinancing even though it can save them thousands of dollars over the life of the loan. Expert stats show that you can save over $20,000 when refinancing a student loan. Plus, refinancing does not harm your credit score. In fact, refinancing could significantly increase your cash flow too. This would not only improve your financial situation but your overall quality of life. What more could you want?

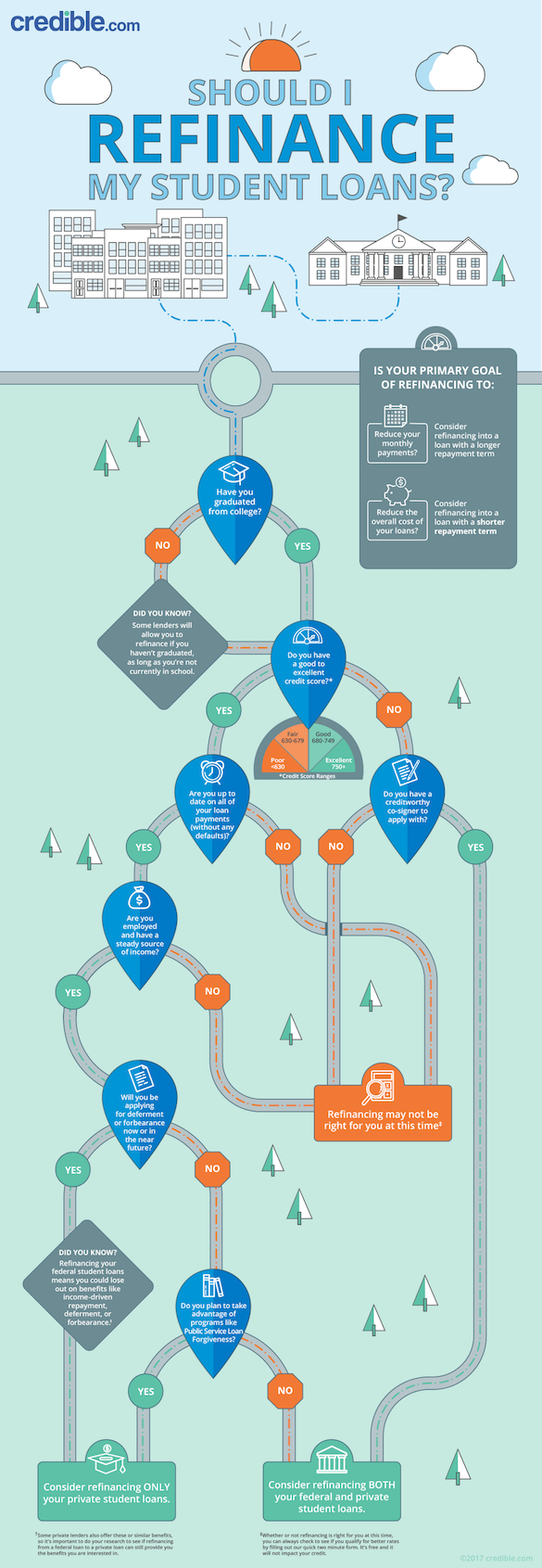

Need Help Deciding?

Even though you can save money refinancing, you might be wondering if it makes sense for your personal situation. After all, these unsecured loans do take on a significant amount of risk to the borrower. To help answer your questions, Credible has created a infographic decision pathway that helps explain the process. It answers questions like:

- Does my enrollment status affect refinancing?

- Can I refinance federal student loans? Private loans? Both?

- How does my credit score affect refinancing decisions?

- Do I need to have a steady income to be able to refinance?

These student loan refinancing questions will help decided your eligibility. If your situation permits, refinancing could be a very good option for you. It will save money on interest and allow you to pay down the principle loan amount much quicker than traditional student loan rates.

Get Answers

If you are within the average student loan borrower category, you might be able to save a substantial amount of money by refinancing. These days the process is easier than ever. Your situation will vary greatly depending on a number of factors. Since every student is unique, you will have to ask your self some important common questions. If you are still in school, working or have other loan obligations, your chances could be much lower. However, there are many scenarios to go through when considering whether or not to refinance your student loan debt. The first step is to get familiar with the decision process, and then move forward towards saving money.

Business First Family Business, Accounting, Finance, Investing, Marketing And Management

Business First Family Business, Accounting, Finance, Investing, Marketing And Management