Is there any sure shot to build wealth? If you ask a finance professional for long term investment advice, it might be difficult to get anything that really works every time. However, you can create wealth and manage a rich lifestyle later on in your life by avoiding several financial mistakes.

As you get older, you might take morning jogs to maintain your health. Be sure, that you have taken the proper actions to maintain your financial health by definition as well. To continue to have wealth in your life through the age of 60, here are the following financial mistakes which should be avoided:

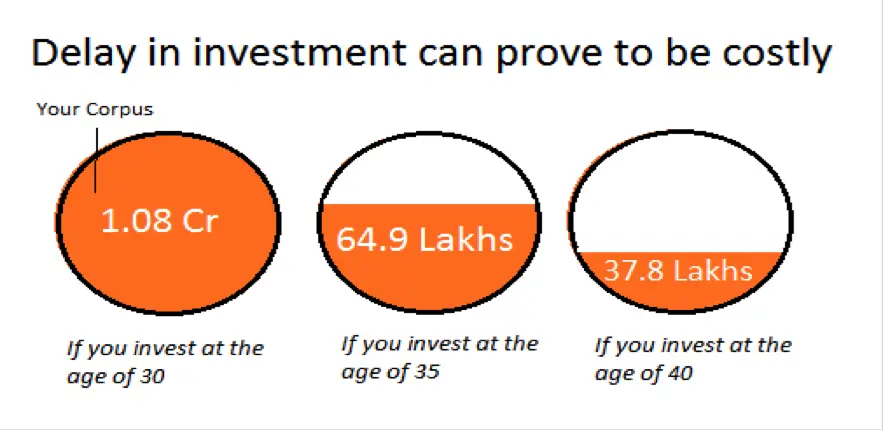

Not Starting Early

For young professionals, spending is more important than investing. Most of the working professionals don’t start retirement planning in the first few years of their career. This delay in planning causes more damages than good, even if the individual saves more in the later years. What one saves during initial years turn into a massive amount over the next 25-30 years.

The longer the delay, the smaller the principle is. The power of compounding ensures that even a small amount grows into an enormous amount over the period.

*We have assumed retirement age as 60, monthly contribution as Rs 5000, rate of return as 10%.

*We have assumed retirement age as 60, monthly contribution as Rs 5000, rate of return as 10%.

Not Taking Risks

When it comes to personal finance, equities give good returns in the long run. However, small investors continue to rely more on traditional investments like bank fixed deposits, PPF, post office schemes, etc. This aversion towards equities could prove to be expensive in the long run. If your current monthly household expenses are Rs 25,000, a 5% inflation rate will push that amount to Rs 66,332 by 2036. Similarly, by 2040, these expenses will surge to Rs 80,627/month. Your investment should also grow at a pace higher than the inflation rate to sustain your lifestyle in the coming years. It can’t be achieved by parking your entire investment in traditional investment avenues.

Having Too Many Monthly Payments

If you have a bunch of services that you pay for monthly, like Netflix, Spotify or Xbox Live subscriptions, you could be making a mistake. Monthly subscription services may seem cost effective, however, they are draining your salary without you even having to think or do anything. They make your pay monthly, but leave you with no tangible ownership of assets. If you are really trying to get your finances in order and start building up your savings, you should consider tightening your belt and cancelling some of your monthly payment services.

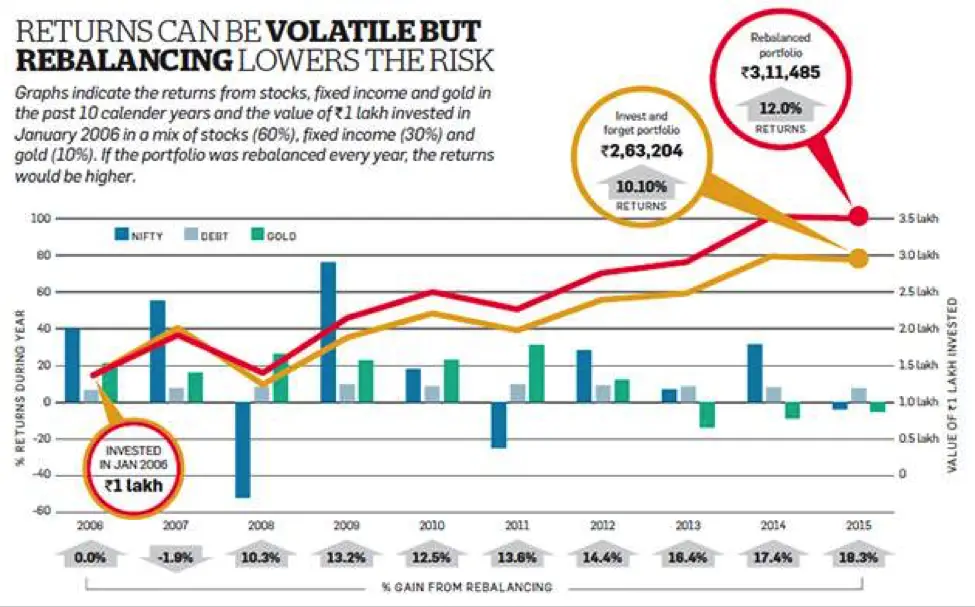

Not Rebalancing Asset Portfolio

Most of the people follow an investment strategy— Invest and then forget. Not many investors rebalance their financial portfolio regularly which is otherwise imperative because returns from different asset classes can vary. For instance, in 2013, BSE Sensex hit 21000 and Nifty also traded at the highest level since 2010. But in 2015, Sensex and Nifty closed at a loss of 5% and 4% respectively.

While fixed instruments give stable returns, gold has been volatile in the last 5-10 years. Over the period, differential returns can also change the asset mix of your portfolio. With the help of rebalancing, it becomes easy to alleviate risk and generate returns.

Investing In Stocks For A Short Duration

Those people who invest in stocks don’t remain invested for long, as they invest in equities to meet their short-term needs and not for wealth creation. As per the AMFI data, small investors redeem around 46% of their investments in equities within two years. The majority of investors watch market ups & downs on a daily basis, and they look at only short-term performance, and if it is not good, they lose their nerves and withdraw their money. The same thing happened during 2008 crisis when most of the investors stopped their SIPs. However, investment in SIPs should be made when the market is low to yield higher returns when the condition improves. If you are in your 30s, invest in bear markets which can help you in the wealth creation.

As said by Warren Buffet, “Focus on the playfield, not on the scorecard,” so keep investing in equity without worrying about the market conditions. Equities give best returns in the long run and therefore, stay invested irrespective of the market fluctuations.

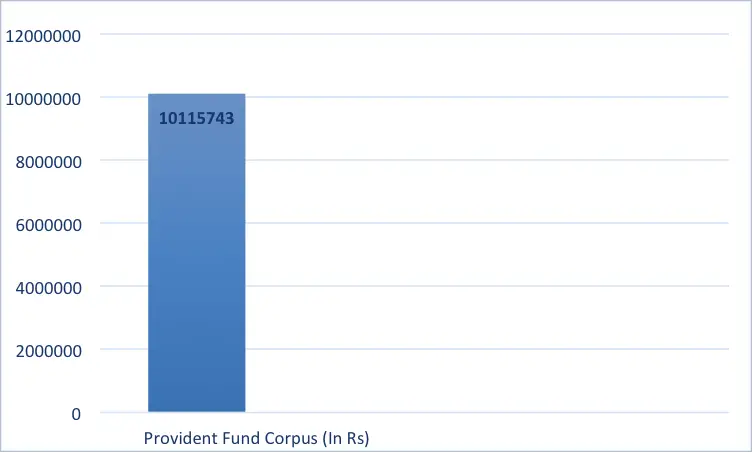

Withdrawing Employee Provident Fund Early

EPF is meant for retirement, but every time a professional changes job, he/she withdraws its employee provident fund, or EPF balance. The money goes into unnecessary expenses, and as a result, retirement corpus becomes zero. It’s a decision which can prove costly when you are a few years away from retirement.

Gene Perret, the famous comedy writer, said about retirement, “it’s nice to get out of the rat race, but you have to get along with less cheese”. So, instead of withdrawal, transfer your EPF in the case of job change and let it continue until retirement. Further, the current PF interest rate of 8.75% can build a huge retirement corpus at the time of retirement, as seen in the following bar graph:

*We have assumed provident fund rate as 9%, current EPF balance as Rs 6,000, Monthly PF contribution as Rs 2000 and an annual monthly increase in income as 10% for doing the calculation at Employee Provident Fund Calculator.

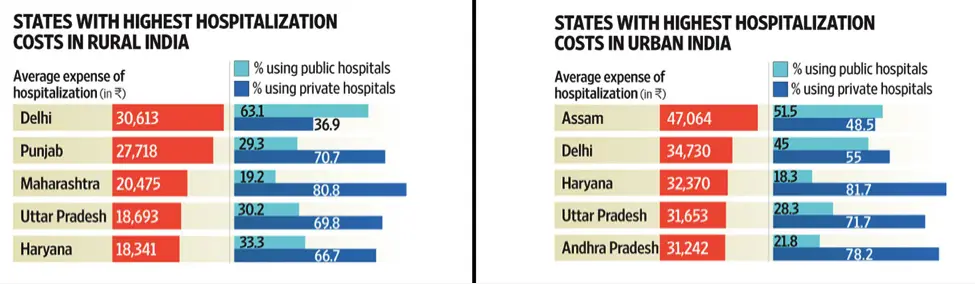

Relying On Corporate Health Insurance

Most of the people solely rely on their corporate health insurance to meet rising medical expenses. However, this cover ceases to exist after retirement. Even those organizations which offer mediclaim cover to their retired employees, trim the coverage. As one grows old, he/she becomes more susceptible to ailments and requires frequent medical care. However, buying health insurance at that time will prove costly, and some insurers will also refuse to give the policy. Moreover, medical expenses are rising at an alarming pace in India.

Health insurance offers risk coverage against rising expenses caused by unforeseen medical expenses. In current times, failing to hold a comprehensive medical cover can prove to a financial disaster. As it is said, “Buy health insurance when you don’t want it, because you may not get it when you want it”. It is imperative that individuals prepare themselves for such medical contingencies and buy a sufficient health insurance cover.

Not Creating An Emergency Fund

Everyone needs an emergency fund. You could lose your job or someone in your family may require medical care or any other unforeseen situation may arise for which you require funds. Most of the people argue that though they have a credit card, they don’t need an emergency fund. However, a credit card offer can give you a cushion of 15-30 days only till the next bill cycle starts. Moreover, credit card companies charge a high-interest rate if the cardholder doesn’t make a timely bill payment. In the absence of an emergency fund, you could be forced to liquidate your assets. To avoid this situation, one should have at least six months of expenses in an emergency fund, including loan EMIs, if any. Any windfall gain, like annual bonus or tax refund, should also be diverted towards an emergency fund. Make sure not to use the fund towards discretionary expenses.

Unnecessary Splurging

Young people spend more than they save or sometimes even more than what they earn. Easy financing options and use of plastic money prevent people from distinguishing between want and need. The prevalence of the fast food industry does not help either. Five bucks here and there for a fast food meal adds up very quickly. They may want to start a SIP or buy a retirement plan, but trendy handbag or shoes come in their way. This urge could prove harmful if it is not curbed at the right time. Further, overspending increases in case of credit cards. To suppress your shopaholic spirit, leave your credit card at home when you go shopping and use only cash. As Warren Buffet said, “Do not save what is left after spending, but spend what is left after saving”, so spend what is left after you are done with your savings.

Mixing Insurance And Investment

Though insurance is a key point of every individual’s financial planning, most of the people use it interchangeably with investment. It is a human tendency to expect ‘something’ in return of the premium and as a result, there has been a rise in a number of people who ‘invest’ in insurance. As term insurance policies don’t have maturity value, most people avoid buying it. Since other insurance-cum-investment policies like endowment, unit-linked insurance policies, etc.; promise a payback, people invest in them to yield a return at the end of the policy term. However, insurance and investments are meant for varying objectives. Term insurance secures the life of your family in case of your sudden demise, while investments give returns to meet your short-term and long-term objectives. The blend of insurance and investment defies the entire purpose. Mainly, two problems arise when you buy an insurance product that has an investment component or vice versa:

- High cost: Term insurance is the cheapest insurance policy but other investment-cum-insurance options like ULIPs, money back plans, etc.; are costly.

- It defeats the purpose of buying insurance: Insurance is meant to give financial security to dependents after the demise of the policyholder. However, market linked insurance products offer a bonus on the basis of the insurance company’s performance. It means if the insured dies away in the initial years or during the time when the market is underperforming, dependents could be left with the inadequate amount.

Insurance and investment are two distinct goals and therefore, should be kept separate.

These mistakes should be an eye-opener for anyone who has yet to reach the age of 60. Certainly, it is better to learn about your financial security sooner rather than later, and avoid easy loans whenever possible. But either way, you should have a much better understanding of how to create and manage wealth by avoiding financial mistakes.

Business First Family Business, Accounting, Finance, Investing, Marketing And Management

Business First Family Business, Accounting, Finance, Investing, Marketing And Management