Icahn holdings are very interesting for individual investors. Highly successful investment portfolios and holdings offer us insight to what companies make great stock picks. In this case, Icahn holdings include Carl Icahn’s portfolio of investments. Even for the most savvy investors, it can be very helpful to see what other successful investors are doing and learn from them. Along with a guide to economic indicators for businesses, the wise advice will certainly help.

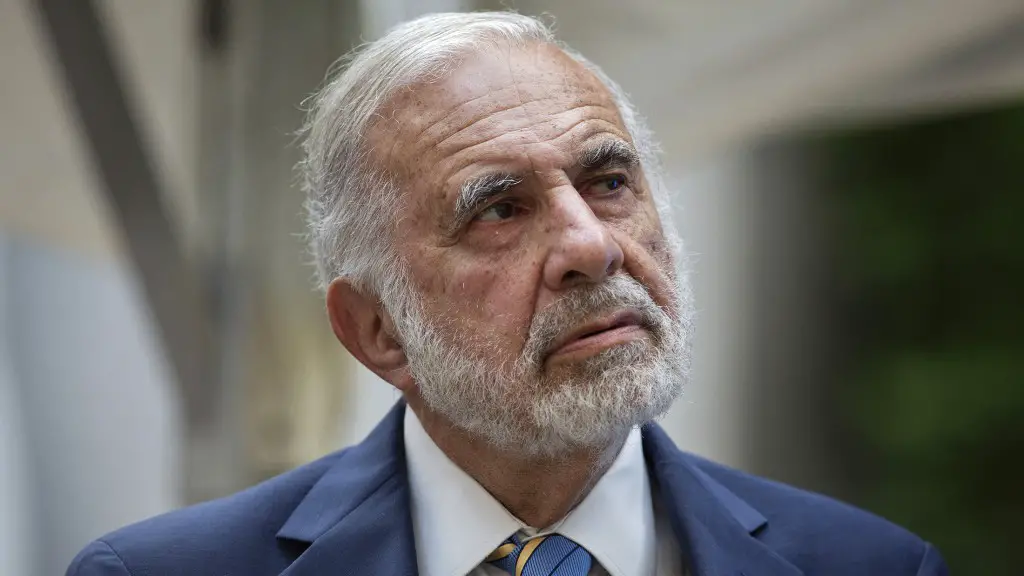

Icahn Capital Management Founder

In case you have not hear of Carl Icahn, he is one of the most popular investors in the industry. He is the founder of Icahn Capital Management LP which is estimated to manage over $30 Billion in holdings. It takes a lot of work, success and perhaps, some luck to manage a portfolio of that size. Certainly, it might be a good idea to look at what Carl Icahn has invested in to help you determine the best shares to buy.

Elite Investor Differences

However, individual investors need to understand the difference between themselves and elite investors that use the services of a prime broker. Depending on your capital available, risk tolerance and market timing, your portfolio holdings will differ greatly from investors like Carl Icahn. Simply looking at the Icahn holdings breakdown will not give you a recipe for success. Larger investors can afford to tolerate more risk, lower returns and withstand harsh market conditions. To learn from them, individual investors must look for the underlying reasons for the investment and decide if it will work within their investment strategy.

Sector Diversification

Icahn holdings are diversified into several sectors. The portfolio is weighted towards services and technology, accounting for more than 50% of investments combined. Other notable sectors include consumer, energy and health care sectors. These sectors give us an idea of what is important to Icahn holdings either now, short term or long into the future.

Large Stakes

Secondly, Icahn holdings has some large stakes in individual companies. Many of these companies are well known, including Apple stock, Paypal, Ebay and Hertz. Some individual investors may want to buy in right away. However, it is important to keep in mind the price and quantity of shares that Icahn’s company were able to secure. There are many more companies that make the list, continuing to grow as the holdings percentage decreases below the 3% level. With a heavy tech presence, I would expect Intuit stock to be somewhere on the list too. Clearly, the Icahn holdings are strategically diversified.

Changes

Icahn does not make changes to his portfolio all that often. Recently however, he sold off shares in three different companies. PayPal, Freeport McMoRan and Nuance are the three companies which did not make the cut this year. However, while he did sell of shares of all these companies, he still owns a considerable stake in all of them. Icahn is still one of the biggest shareholders of PayPal, Freeport McMoRan and Nuance. This can be confusing for shareholders trying to learn from him. However, it shows the importance of diversifying your portfolio to mitigate risk. Make sure you remember the importance of balancing your investment portfolio.

Stocks To Consider

With that said, you may not want to invest like Icahn holdings professionals do, but you can still gain some knowledge from the advice of an elite investor like Carl Icahn. It is certainly better than looking for penny stocks to buy today. He had one particular tip for 2016 that you may want to make use of as a novice investor. He recommends buying stake in Allergan (AGN) this year. He himself purchased a large stake in the company, and he has nothing but good things to say about its CEO Brent Saunders. The specialty pharmaceutical company engages in developing, manufacturing and distributing products of all forms: brand, generic and biosimilar. You may not want to trade like the elite, but you should certainly take their advice when it is given.

To invest like Icahn Capital Management, many years of investing and experience are required. We are not saying you should start to learn the basics of Forex trading just yet. However, it only takes a few moments to look up a few investor tracking websites that show all the trades of companies like Icahn holdings. If you follow closely, you might just pick up on some of the underlying investment strategies being used.

Image from http://www.carriermanagement.com/news/2015/10/28/147124.htm

Business First Family Business, Accounting, Finance, Investing, Marketing And Management

Business First Family Business, Accounting, Finance, Investing, Marketing And Management