PayPal is a financial services company that nearly everyone knows. But recently, the company made some new moves that no one was expecting. The PayPal cashback program was announced a couple months back, but it is only just now that business owners are learning about what the program is an how it can benefit your business. If you are interested in learning more about the PayPal cashback card and how you can use it to grow your business, keep reading below.

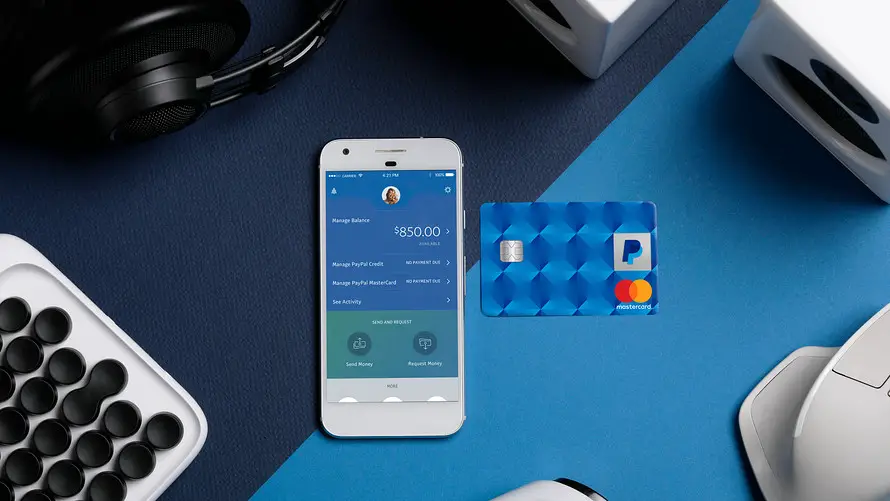

PayPal Cashback Mastercard

PayPal’s cashback program requires users to apply for a cashback Mastercard account. Simply having a PayPal account is not enough to earn cash back. Then, once approved, the PayPal Mastercard can be used to earn 2% cash back on every purchase you make. The PayPal cashback credit card has variable purchase APR of 16.99%, 24.99% or 27.99%, based on credit worthiness. It is important to remember that you will need to apply to get access to the rewards program. But, once you do you stand to earn serious cash to invest back into your business.

2% Cash Back

The PayPal cashback program gets you access to 2% cash back on every single purchase you make without restrictions. There are no blackout dates. You earn cash no matter what day you make your purchase. That same amount, 2%, is earned on purchases made at every store that accepts Mastercard. The rate does not vary by store. For business owners, this means you can earn money buying restaurant equipment for your business or making personal purchases at the grocery store. This can earn you some serious bucks to reinvest back in your business, which makes the PayPal cashback program so enticing for business owners like you.

No Annual Fee

The PayPal credit card you use to earn cash back has no annual fee. This is a huge advantage to other business credit cards that charge high annual fees. Those annual costs add up and take away money that could be going to expanding operations for your business. Thankfully, with the PayPal cashback credit card, you can earn money for free just by spending money you would have spent anyway.

No Redemption Limit

Unlike other cash back credit cards, there is no redemption limit for PayPal’s program. No matter how much cash you have earned, you can cash out. Then, the money gets deposited right into your PayPal account. So if you need that $2 in your account to pay for postage or you would rather wait until you have $1,000 saved up to pay for a new office copier, you can do that without worry. This benefits small business owners in particular, who often have cash flow problems that those few dollars back could help fix quicker than the Big Four ever could.

Business Applications

For business owners in particular, the PayPal cashback credit card has serious advantages. If you decide to use the PayPal credit card as your personal credit card, you can earn tons of money back on your everyday purchases. Then, you can cash out at any time at all to re-invest that money into your business. It is an easy way to make money to fund business expansion and growth for your company. Just be sure to pay it off at the end of each month, and your growing business can seriously benefit from the PayPal cash back program.

If you need a personal credit card that can help you improve business success for your company, the PayPal cashback card is one of the best business credit cards to consider. The 2% cash back rewards are better than almost all other cash back credit cards. They also have no restrictions or limitations, unlike similar cashback cards that promise to help you learn how to build business credit. Use this post to help you decide whether or not a PayPal Mastercard is the best thing for your business finances. Then, let us know what you think of the credit card below.

Photo from https://www.marketwatch.com/story/paypal-just-announced-it-has-a-new-cashback-credit-card-should-you-use-it-2017-08-31

Business First Family Business, Accounting, Finance, Investing, Marketing And Management

Business First Family Business, Accounting, Finance, Investing, Marketing And Management